Business backed in Lincolnshire in spring budget

Commenting on the 2021 Budget Lincoln Chamber of Commerce Chief Executive Simon Beardsley said: “It’s been a long road to get to this point but there’s much to welcome in this Budget for business communities across Lincolnshire and beyond.

“It is pleasing to see the Chancellor has listened and acted on our Chamber network calls for immediate support to help struggling businesses reach the finish line of this gruelling marathon and to begin their recovery. Extensions to furlough, business rates relief and VAT reductions give organisations a fighting chance not only to restart, but also to rebuild.

Advertisement

Hide AdAdvertisement

Hide Ad“We particularly welcome the massive ‘super deduction’ investment incentive that the Chancellor has put in place for the next two years. This responds directly to our call to encourage those businesses that can, to invest and grow.

“While no business will relish paying higher rates of Corporation Tax in the future, the impact of the Chancellor’s tough decision is blunted by the big new incentives for investment, lower rates for the smallest firms, and the extension of Coronavirus support measures in the short term.

“This Budget provides reassurance to businesses, provided that they are able to restart and rebuild according to the Government’s road map. If organisations face unexpected bumps in the road, the Chancellor must be prepared to take action until the economy is firing on all cylinders again.”

Pat Doody, chairman of the Greater Lincolnshire Local Enterprise Partnership also welcomed the further support for businesses affected by the pandemic. This includes the extension of furlough until September, additional support for the self-employed and re-start grants to support businesses to restart after lockdown that he says will all make a big difference when the economy starts to re-open.

Advertisement

Hide AdAdvertisement

Hide AdMr Doody added: “The extension to the VAT reduction for hospitality, accommodation and visitor attractions is of particular benefit in Greater Lincolnshire where we have a large and normally thriving hospitality sector.

“We are delighted that our bid for a Humber Freeport has been successful. We have worked in partnership with the private and public sector to develop a compelling bid for freeports on both sides of the Humber, and it is one that we know exporters and importers will welcome.

“A Humber Freeport will turbocharge our economy and support levelling up in our area, bringing increased investment of £3.5bn and around 7,000 high-quality new jobs.”

There was also welcome clarity in the Chancellor’s speech about the UK Shared Prosperity Fund which will support communities as the Government moves away from EU structural funds.

Advertisement

Hide AdAdvertisement

Hide AdThe new Levelling Up Fund is also providing further investment in infrastructure such as town centre and high street regeneration, local transports projects and cultural and heritage assets, with millions from the Towns Fund going to boost nearby local centres including Newark, Lincoln, Boston, Skegness and Mablethorpe.

Mr Doody said the Greater Lincolnshire LEP will work closely with Lincolnshire County Council and others to ensure their voice is heard when it comes to attracting much-needed funding to the area.

However Lee Barron, TUC Midlands Regional Secretary said: “We are yet to be convinced that Freeports will solve the problems facing our economy as we come out of the pandemic.

“We will be arguing strongly that any Freeport in the East Midlands must be established on principles that promote good quality jobs and protect against opportunities for tax evasion.”

Advertisement

Hide AdAdvertisement

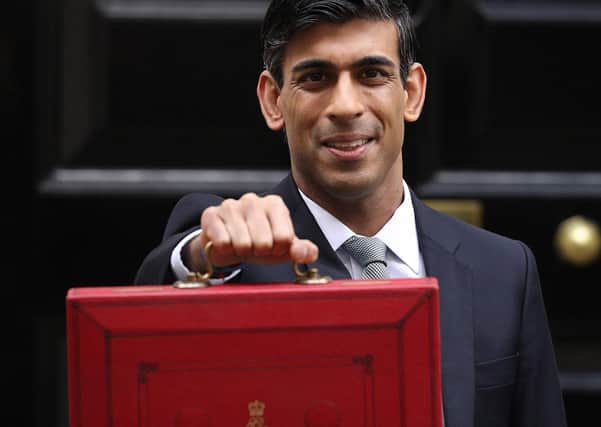

Hide AdChancellor Rishi Sunak said today that as part of his plan for jobs, businesses across the East Midlands can expect to benefit from a new Restart Grant – a one off cash payment of up to £18,000 for hospitality, accommodation, leisure, personal care and gym businesses; a new UK-wide Recovery Loan Scheme to make available between £25,000 and £10 million to help businesses of all sizes through the next stage of recovery; an extension of the VAT cut to 5% for the hospitality, accommodation and tourism sectors until the end of September; additional cashflow support through an extension to the loss carry back rules worth up to £760,000 per company; and a three month extension to the 100% business rates holiday, with the vast majority of eligible businesses receiving 75% relief across the year.

To protect the incomes of individuals as the country begins to unlock through the Prime Minister’s roadmap, his is extending the furlough scheme and Self-Employment Income Support Scheme through to September; maintaining the £20 per week uplift to Universal Credit for another six months; and eligible Working Tax Credit claimants are set to benefit from a one-off payment of £500, to provide continued support over the equivalent period as those in receipt of Universal Credit.

The Budget also sets out steps towards an investment-led recovery; including extending the Annual Investment Allowance, freezing Alcohol and Fuel Duties, and introducing a mortgage guarantee scheme - to help generation rent become generation buy.

In addition to UK-wide measures to extend support for people and businesses the Budget also included several announcements which will boost jobs and opportunities across the East Midlands

Advertisement

Hide AdAdvertisement

Hide AdChancellor of the Exchequer Rishi Sunak said: “People shouldn’t have to leave their local area to get on in life or further their career. Levelling up means spreading opportunity and investment throughout the UK—ensuring everyone has a fair chance no matter where they live.

“My budget this year includes substantial investment across the East Midlands in the communities that need it most.”

The government has published the prospectus for the new £4.8 billion Levelling Up Fund, which sets out criteria on how local areas can bid for cash as part of the 2021-22 round of funding. The Fund will invest in local infrastructure and support the economic recovery from Covid

The Chancellor also announced the Community Ownership Fund: with £150m being provided to help protect the local institutions and facilities which are important to people. It will support community groups to take ownership of facilities such as pubs, sports clubs and theatres, where these are at risk of being lost – to ensure they can play a central role in towns and villages across the UK for years to come.

Advertisement

Hide AdAdvertisement

Hide AdThe Government is also commissioning a new National Infrastructure Commission study on towns and regeneration which will look at how to maximise the benefits of infrastructure policy and investment for towns.

The Chancellor will continue to spread the feel good factor across the country by pumping £2.8m new cash into a bid to host the World Cup in 2030, with £25m new funding announced alongside this to help the grassroots game grow – enough to build around 700 new pitches across the UK.

In two further boosts for major events, £1.2m new funding will be earmarked so the Women’s Euros goes ahead in England in July 2022 following delays due to Covid, and £28m of new cash will also be announced for Jubilee organisers to deliver the UK-wide Queen’s Jubilee bank-holiday bonanza in June 2022.

Employers who hire a new apprentice from April 1 to September 30 will receive £3,000 per new hire. Apprenticeships are popular in the East Midlands, where 28,600 apprentices started their apprenticeship during the academic year 2019/2020.

Advertisement

Hide AdAdvertisement

Hide Ad£126 million is being provided to extend expansion of traineeships in England for the 21-22 academic year, providing up to 43,000 traineeship placements. This will fund high quality work placements and training for 16-24-year olds who are NEET (not in education, employment or training) in the 2021-22 academic year. Over 63,000 people in the East Midlands would be eligible to take up a traineeship.

Around 109 quarrying sites in the East Midlands will benefit from a freeze in the Aggregates Levy.

The 80% of households in the East Midlands who own a car will benefit from a fuel duty freeze.

Skegness, Mablethorpe, Boston, Lincoln and Newark will benefit from a share of £200 million funding from the Towns Fund to support their long-term economic and social regeneration as well as their immediate recovery from the impacts of COVID-19.

Breakdown:

Newark (£25m)

Advertisement

Hide AdAdvertisement

Hide AdNewark’s funding seeks to improve social mobility, alleviate deprivation, and improve workers skills across the community – all of which will help the area to level up.

Skegness (£24.5m)

Skegness’ funding focuses on investing in local infrastructure to support connectivity and opportunity for people within the town.

Mablethorpe (£23.9m)

Mablethorpe’s funding looks to create a healthy and diverse economy – through encouraging healthy lifestyles, personal mobility and economic participation.

Boston (£21.9m)

Boston’s funding will contribute to creating sustainable economic growth and increasing the connectivity between communities – helping to improve the jobs on offer to residents.

Lincoln (£19m)

Advertisement

Hide AdAdvertisement

Hide AdLincoln’s funding will enhance local infrastructure helping to boost connectivity within the town – allowing the community to stay connected and enabling access to better opportunities for all.

Nicholas Smith, Director and Head of Tax at Duncan & Toplis, which has a branch in Sleaford as well as other towns across the county, commented: “As he did last year, the chancellor promised to do ‘whatever it takes’, setting out a three point plan for fixing public finances and building the future economy, but this Budget was bold and innovative in many ways and I wonder how the public will react.

“While the cost of these announcements may be eye-watering, in my view it’s money well spent as it minimises the even greater cost of long term mass unemployment. The support measures should go a long way to ensuring our businesses can bounce-back quickly, preventing companies from closing for good and protecting people’s livelihoods.

“Overall, there was a theme of the chancellor introducing a more progressive tax system. Here, he has taken a sensible - though perhaps slightly brave - approach. Largely, he has decided not to increase taxes, at least for a few years until the economy has recovered, rather than risk hampering growth at a time when businesses need the most support.

Advertisement

Hide AdAdvertisement

Hide Ad“As we work through the cost and the administrative pain that businesses have faced following the exit from the European Union, in addition to the coronavirus pandemic, the incentives announced today will be most welcome. But, fundamentally, we need the UK to be a global, outward-looking economy, and with global trade, comes a greater need for digital skills which are vital for online marketplaces and working with foreign tax authorities. Unfortunately, I saw little announced to support this in the chancellor’s statement.

“As expected, the Coronavirus Job Retention Scheme, which is still supporting the income of around 4.7 million furloughed workers, is being extended until September. As was the case last autumn however, the scheme will be gradually scaled back, with employers required to pay an increasing share of each furloughed worker’s pay from the end of June until the scheme ends in September. This is great news for employers and workers across the country.

“With the previous end date having been set way back in November, it seemed ever clearer that an extension was required, especially when the third lockdown began and also when the Prime Minister’s ‘roadmap’ revealed that restrictions for some businesses would remain until late June.

“The gradual phasing out of the scheme also avoids concerns that the scheme is propping up ‘zombie’ jobs which will never return and also a ‘cliff-edge’ which would cause a sudden wave of unemployment.

Advertisement

Hide AdAdvertisement

Hide Ad“Another unsurprising but welcome announcement is that there will be two more rounds of the Self-Employment Income Support Scheme, which grants self-employed people 80% of three months’ average trading profits up to £7,500. This will be available to a further 600,000 people thanks to a change in the way it’s calculated. This is good news for the newly self-employed, as those who submitted their tax returns for 2020 by 2 March can now access the SEISS scheme.

“Extending the scheme is crucial to self-employed people who’ve faced their businesses closing or facing reduced trade as a result of the pandemic, it should also mean some of the 3 million individuals who were cut off from the scheme previously should finally be able to get some much needed support. However, without action to support self-employed people with higher earnings or those whose trading profits make up less than half their income, the majority of these people will continue to miss out. There is also no concession to the hundreds of thousands of directors of limited companies who pay themselves largely through dividends.

“With many people having lost their jobs as a result of the pandemic, and with more redundancies likely as the furlough scheme is wound to an end in September, the chancellor has announced more support for traineeships and apprenticeships.

“The support will come in the form of additional funding to existing schemes, worth £126 million. It means companies who take on apprentices, for example, will receive up to double the cash incentive which was on offer previously. This means employers who take on an apprentice of any age can now receive £3,000 in support. Employees can also take on flexi-job apprenticeships, enabling them to train and work in one sector while working in another.

Advertisement

Hide AdAdvertisement

Hide Ad“Unemployment is at its highest level for almost five years, with younger and lower-paid workers bearing the brunt of job losses so this will help to encourage companies to help younger and older workers reskill and start new careers.

“The stamp duty holiday is credited with having provided a great deal of support for the property market and sustaining house prices and the £500,000 nil rate on stamp duty land tax will continue until 30th June, as expected. It will then be reduced to £250,000 for a further three months, encouraging the sale and purchase of residential properties across the summer.

“The chancellor also announced a mortgage guarantee scheme which will help people with small deposits get on the property ladder. Perhaps a more targeted approach than the stamp duty holiday, the scheme will offer an incentive to lenders to bring back 95% mortgages which have virtually disappeared during the pandemic.

“While the scheme seems sensible in principle, it will not be limited to first time buyers or new-build homes and it is capped at £600,000. It’s hard to understand why these elements of the scheme were decided upon as it would surely reduce the impact the scheme has on supporting the residential construction sector, lower earners or first time buyers (how many first time buyers look to buy a half a million pound home?).

Advertisement

Hide AdAdvertisement

Hide Ad“The scheme bears similarity to the Help to Buy mortgage scheme from a few years ago, but while this did help many to buy their first home, it also increased property prices, which has the opposite effect.

“Nonetheless, the property sellers and those who can make use of the scheme will be pleased with the support.

“As hoped, now is not the time for detailed tax rises, but the chancellor did pave the way for tax rises when the economy has recovered.

“With the cost to the treasury mounting, tax rises are perhaps inevitable. Possibly as a way of preventing the ‘bad’ news from overshadowing the ‘good’, instead of announcing these today, the government is to run a series of tax consultations from March 23 which may well lead to further tax rises in autumn.

Advertisement

Hide AdAdvertisement

Hide Ad“One of the most striking tax announcements is an increase in corporation tax which is to rise to 25% from April 2023. While this is a 6% rise, the rate will still be the lowest in the G7, and small businesses with profits of up to £50,000 will continue to pay the current rate of 19%. There will also be a taper for companies with profits of up to £250,000, meaning that only larger companies will pay the full, higher rate. The corporation tax rise was expected by many, but allowing time for the economy and businesses to recover from the pandemic before its introduction seems sensible.

“The chancellor set out that he plans to achieve ‘Sustainable public finances’, but explained he will not raise the rates of income tax, national insurance and VAT. He stressed that it will take decades for the government to repay the debt generated by the pandemic, so he is taking a very long term view which means avoiding immediate tax rises.

“While there were few tax changes, there was plenty by way of targeted tax deductions:

“The super deduction, which allows companies which invest to reduce their tax bill is new and brave. Under this, businesses can reduce their tax bill by as much as 130% of the cost of the investment in plant and machinery. This bold decision could make a major difference in supporting an investment led recovery, unlocking cash reserves to support growth.

Advertisement

Hide AdAdvertisement

Hide Ad“There is more good news for retail and hospitality with business rates relief extended into 2021-22. The existing business rates holiday has been extended for three months, until the end of June and the rate will continue to be discounted by two thirds (up to a limit of £2m per premises) until April 2022.

“One of the touted benefits of leaving the EU is the greater freedom it allows for the chancellor to adjust the rate of VAT, and this is demonstrated under the chancellor’s use of reduced VAT as a fiscal incentive: The 5% reduced rate for VAT for hospitality and tourism will continue until September 30, when it will rise to a still-reduced rate of 12.5%. This is good news for these sectors which have been among the most affected by the pandemic. Furthermore, freezing the VAT registration threshold at £85,000 means the UK’s system is still more generous than our European neighbours.

“Meanwhile, from April 2022, the income tax personal allowance and higher rate threshold will be uprated in line with the consumer prices index, as planned. This will then be maintained until April 2026. This should not reduce take-home pay, but it will mean higher earners continue to contribute more, with people pushing into higher tax brackets as their income increases.”