Budget 2024: Jeremy Hunt cuts National Insurance and reforms child benefit but tax burden still climbing

and live on Freeview channel 276

Jeremy Hunt has announced another cut in National Insurance and also a reform to child benefit in his last Budget before the election.

Some polls have Rishi Sunak's party more than 20 points behind Labour, and Hunt is desperate to give the government a boost ahead of the general election later this year.

Advertisement

Hide AdAdvertisement

Hide AdHunt once again cut National Insurance by 2 percentage points and also announced an extra £6bn for the NHS, however this will have to be paid for by public sector productivity.

The tax burden is still set to reach it's highest level since 1948.

Follow our live blog below for the latest news, updates and analysis from the 2024 Spring Budget.

NationalWorld's Budget 2024 liveblog

Key Events

Welcome to NationalWorld's Budget 2024 live blog

We'll be updating you throughout the day with the latest news, analysis and announcements as Chancellor Jeremy Hunt prepares to announce the 2024 budget.

What can we expect from today's announcement?

NationalWorld Politics Editor Ralph Blackburn has given his predictions ahead of budget announcement later today.

Tax cuts have been a key part of Tory Party policy for some times but the Chancellor will be very concerned about making any tax cuts that could risk fuelling inflation - after all he got his job after Liz Truss’ disastrous mini-Budget.

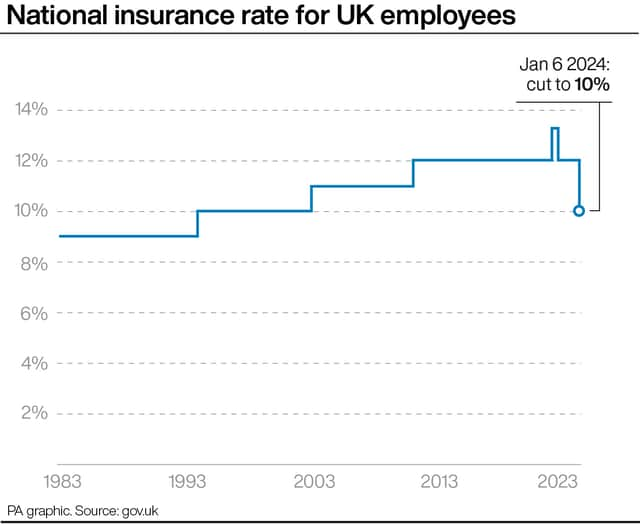

Hunt also looks likely to cut National Insurance once again. In the autumn, the Chancellor slashed this by two percentage points - from 12% to 10% - and it’s thought he wants to go further.

Read more of Ralph Blackburn's predictions here: 2024 UK Budget predictions: what will Jeremy Hunt do with income tax, national insurance and housing

'The Tories promised to fix the nation’s roof... they are now burning the house down'

Labour's shadow chancellor Rachel Reeves has taken aim at Jeremy Hunt and the Conservative Party ahead of the 2024 budget announcement.

Reeves said: “This Budget should be the final chapter of fourteen years of economic failure under the Conservatives that has left Britain worse off.

“The Conservatives promised to fix the nation’s roof, but instead they have smashed the windows, kicked the door in and are now burning the house down."

Reeves said that in Labour's view "nothing the Chancellor says or does can undo the economic vandalism of the Conservatives over the past decade."

She added: “The country needs change, not another failed Budget or the risk of five more years of Conservative chaos. Under Keir Starmer’s leadership, the Labour Party has changed and is now the party of economic responsibility. Only Labour has long term plan to deliver more jobs, more investment and to make working people better off.”

Did the Chancellor’s last Budget deliver what it promised?

We've taken a look back at the last Spring Statement to see just how much progress has been made on Hunt's previous promises.

Cabinet arrives at Downing Street

Rishi Sunak's cabinet has arrived at Downing Street ahead of the budget announcement due to be made later today.

Home secretary James Cleverly, foreign secretary Lord Cameron and defence secretary Grant Shapps are among those arriving at Downing Street this morning.

The Chancellor's Spring Statement is expected to be delivered at around 12.30pm.

Good morning from Westminster

Good morning from an overcast Westminster, where Jeremy Hunt will be announcing the Budget in just over three hours time. I'm NationalWorld's politics editor, and I'll be bringing you all of the updates from the press gallery overlooking the House of Commons. Please email with your thoughts and reaction to [email protected].

When is the Budget today?

Here's a quick overview of Budget timings today:

- 8.30am Rishi Sunak chairs Cabinet

- 12noon Sunak is quizzed at Prime Minister's Questions

- 12.30pm Jeremy Hunt announces the Budget

- 1.30pm Opposition leaders Sir Keir Starmer and Stephen Flynn respond

- 2.30pm Office for Budget Responsibility holds a press conference

- 5pm Hunt addresses Tory MPs at the 1922 Committee

Can Hunt afford to cut tax?

Jeremy Hunt will hope that the Budget can arrest his party’s slide in the polls, which saw the Conservatives slump to their worst ratings with pollster Ipsos in 46 years. The Chancellor got little credit for cutting national insurance contributions in the autumn, and he is under pressure from his backbenches to cut tax again.

Both the Chancellor and the Prime Minister were heavily hinting at further tax cuts earlier in the year, however the noises out of the Treasury have since gone quiet. The problem for Hunt is that the fiscal headroom - the amount of money he has to spend within the government’s self-imposed rules - has reduced, as borrowing costs have gone up.

There is also the question as to whether cutting taxes will boost the Tories’ electoral chances. Most recent polls have shown the public are in favour of protecting ailing public services over slashing taxes. However, it’s likely that to afford any form of tax cuts, Hunt will have to reduce departmental budgets going forward.

Budget predictions: income tax

One of the big questions for the Budget today is will Jeremy Hunt cut income tax?

Just over a month ago, it appeared almost nailed on that Sunak and Hunt would cut this. The Prime Minister had said at the start of the year that his “priority” is to “keep cutting people’s taxes”, and Tory backbenchers are convinced that their best chance of a recovery in the polls is by cutting income tax.

However, since then, the Treasury’s fiscal headroom has reduced after the latest forecasts by the Office for Budget Responsibility, the UK has entered a recession and inflation has remained sticky at 4%. The Chancellor will be very concerned about making any tax cuts that could risk fuelling inflation - after all he got his job after Liz Truss’ disastrous mini-Budget.

Hunt told Sunday with Laura Kuenssberg that any tax cuts will have to be “sustainable” and “affordable”. Now often at the Budget, Chancellors want to keep a rabbit in the hat, to pull out on the biggest stage to get maximum attention. There are murmurs in Westminster that this could happen, however this time I think an income tax cut is out of reach of Hunt. If conditions do improve, it's more likely we would announce a cut in a pre-election Autumn Statement or include it as part of the Tories' manifesto.

Budget predictions: National Insurance

If Hunt is unable to make a dent in income tax, he will almost certainly take a look at cutting National Insurance contributions. In the autumn, the Chancellor slashed this by two percentage points - from 12% to 10% - and it’s thought he wants to go further.

Cutting National Insurance is cheaper than income tax and is thought to be less inflationary as only people in work pay it. It also has a bigger impact on workers on lower salaries. The Chancellor will have to bring in some form of tax cut in this Budget, and I think it will be National Insurance.